NexML is a Decision Intelligence AI platform built to support Credit Union

decisions with clarity, consistency, and control.

Built for real Credit Union decision environments

To assure accuracy experienced NLP experts at Innovatics incorporate multiple elements of conversational AI such as:

NexML is designed specifically for these conditions.

It supports AI-assisted decisions without removing accountability, ensuring every outcome can be understood, explained, and defended.

What NexML enables

NexML helps Credit Unions move from fragmented decision support to a consistent decision framework.

Bring decision inputs together

Combine policy guidance, member behavior, and risk indicators into a single decision flow.

Explain decisions at the moment they’re made

Generate human-readable explanations for approvals, declines, and exceptions.

Support human judgment

Provide clear guidance and explanations without automating away control.

Govern decisions by design

Maintain traceability, version history, and audit readiness automatically.

Decision Intelligence, Not black-box AI

Traditional AI tools often focus on prediction accuracy alone.

NexML focuses on decision quality.

- Explainability is built in

- Policy alignment is explicit

- Decisions remain reviewable over time

One platform. Multiple decision areas.

Designed for gradual adoption

NexML does not require Credit Unions to transform everything at once.

- Start with one decision area

- Validate consistency and explainability

- Expand across lending and risk as confidence grows

This makes NexML practical for institutions that value stability and control.

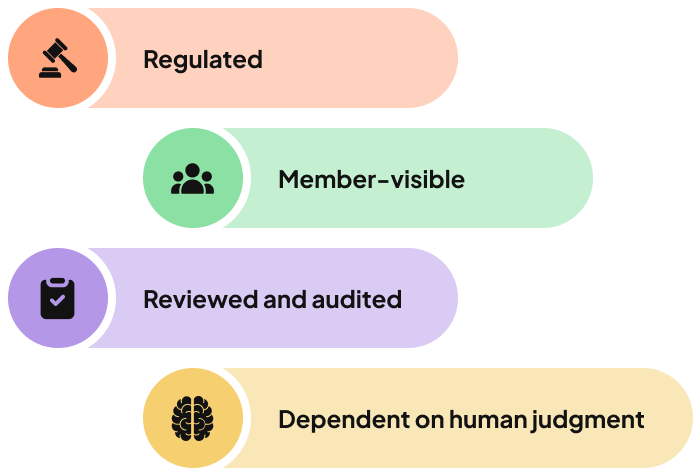

Built to stand up to scrutiny

Every decision supported by NexML is designed to be:

- Explainable to members

- Reviewable by internal teams

- Defensible during audits

This helps Credit Unions reduce operational risk while improving decision confidence.

Why Innovatics

Innovatics builds platforms for organizations where decisions matter.

Regulated Environments

Responsible AI Adoption

Long-term Operational trust

Ready to transform your decision-making?

NexML can bring clarity, consistency, and control to your

Credit Union's lending and risk decisions.