What is Financial Analytics?

Imagine having the capabilities of a financial wizard at your fingertips, deciphering the intricate language of financial numbers to unveil the untold stories within your business. Welcome to Innovatics financial analytics program, where we, as your trusted AI and Advanced Analytics companions, illuminate the path financial analytics to open new revenue streams, tap into minimize churn, risk, predict and control financial failures.

-

60%

CFOs claimed that not having data culture is biggest obstacle to growth.

-

49%

Of finance professionals worry cash flow data is unreliable.

-

92%

Of financial leaders are facing issues in managing finance data effectively.

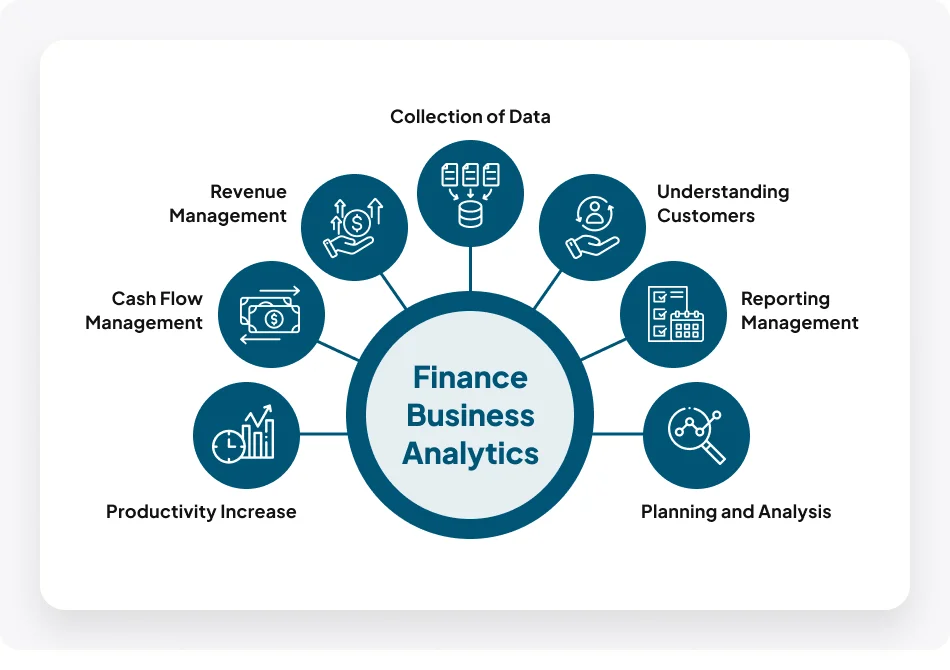

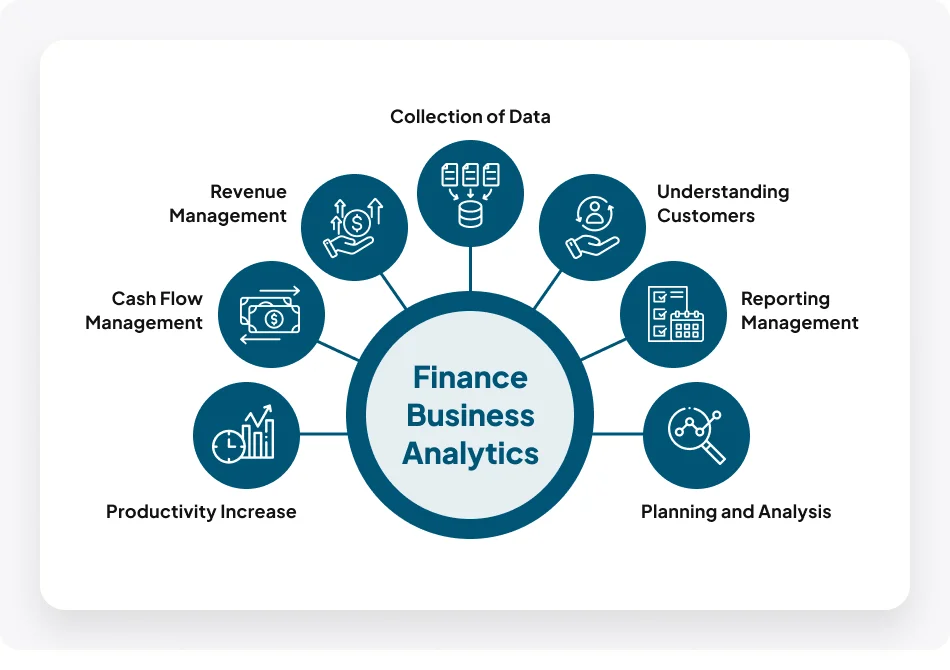

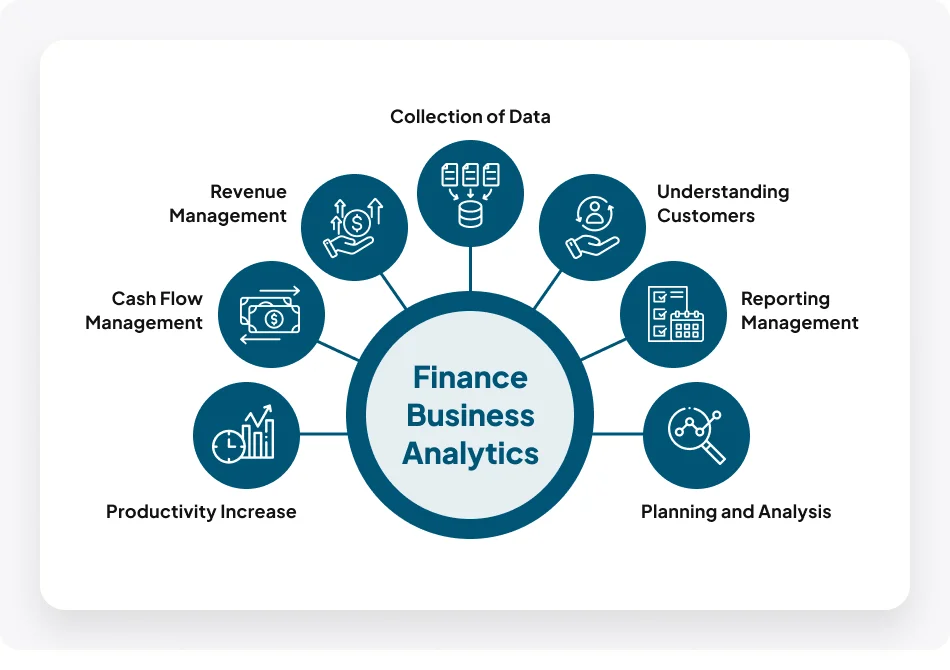

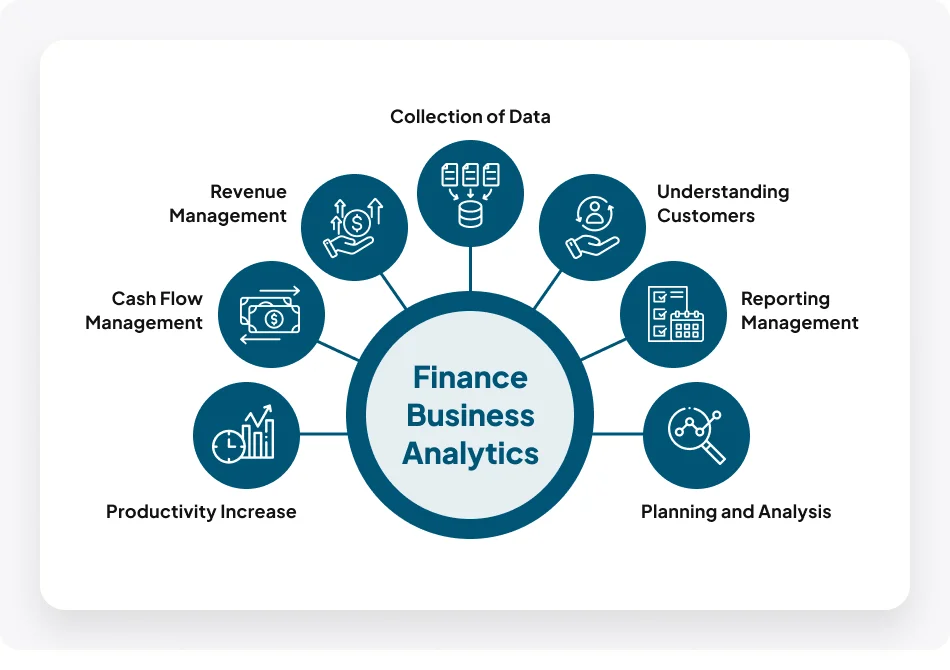

How we Supercharge your Finance Team

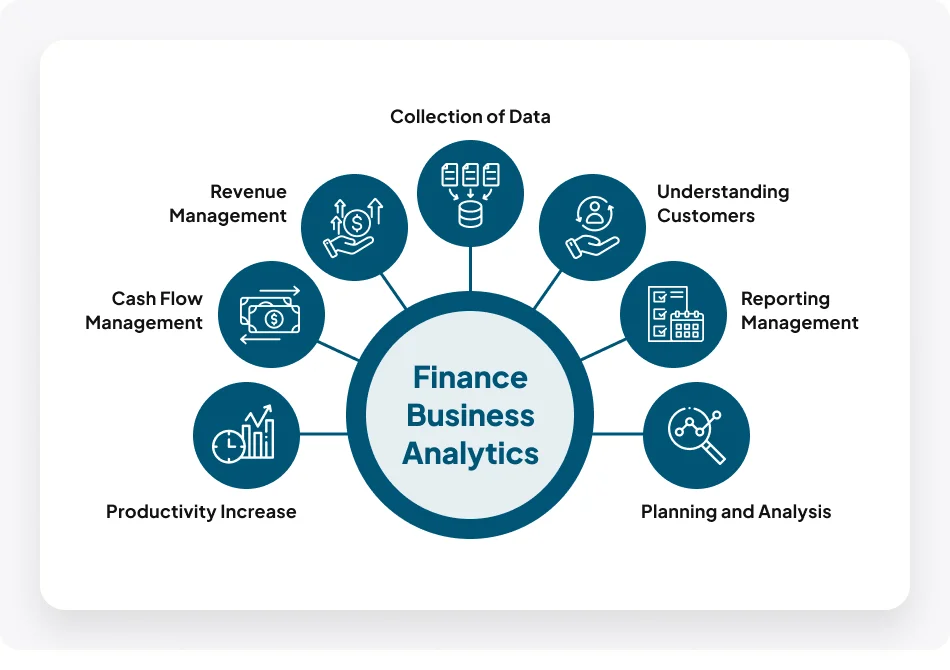

Process vast amounts of Financial Information, Identify patterns, and Derive meaningful insights.

Talk to the expertThe Role of modern CFO (Chief Finance Officer)

The challenges are affecting financial executives who have depended on cost-based planning. However, in order to move enterprises ahead, finance chiefs' focus has changed from lowering expenses to revenue development. So, in addition to being the protectors of financial health, today's CFOs must also create value.

Innovatics Approach on Modern financial Data analytics

Modern data management enables you to transform data into your organization's most valuable asset. Our approach combines technology and techniques to analyze data from all sources and offer reports that assist management in making key decisions.

Such an approach towards financial analytics allows business to operate at its peak efficiency. You get to analyze real-time financial data to predict, plan, budget, and generate reports into one unified financial analytics process.